Finding product/ market fit is like flying

Considerations for how to build a viable and scaled business

Section 1

In the beginning

Product/market fit is one of those terms that has become ubiquitous in the start-up and entrepreneur community. This ubiquity is a double-edged sword where meaning and application has dulled over time. The implication for start-up founders and employees is a disconnect between how success is defined, progress measured, and priorities set and managed. This disconnect often occurs in two places: between investors and founders and between founders and employees.

This article explores a practical approach for redefining and applying product/market fit as a methodology for building a viable, scaled business.

A brief history

The term product/market fit was coined by Marc Andreesen or Andy Rachleff and adopted and popularized by Steve Blank and Eric Ries as a key tenet of the lean startup movement. During the first decade of the twenty-first century the largely Silicon Valley-based start-up and entrepreneur community needed a construct for building and assessing the viability of new internet-enabled products.

Product/market fit was introduced in the early 2000s as a framework to understand the interplay between new technology solutions and rapidly evolving, digitally enabled customer behaviors and markets. In its most basic interpretation product/market fit as defined by Marc Andreesen is still applicable to today’s start-up and entrepreneurial environment: “Product market fit means being in a good market with a product that can satisfy that market.”

Section 2

Evolution

In any sort of nuanced context this product/market fit definition needs a refresh for application to today’s opportunities and solutions.

We aren’t in the same climate of rapidly evolving, digitally enabled customer behavior and markets that existed 20 years ago.

Consider the following complexities to the identification and capture of a good market:

- The available industries primed for digital-only solutions and not dominated by big tech i.e. not e-commerce, not cloud infrastructure, not operating systems, not digital media, not content streaming, not digital advertising, not search, not social, not mapping/navigation, ummmm?

- Enhanced focus on and emerging regulation of customer privacy online i.e. GDPR, CCPA

- Legacy value chains underpinned by regulation and governed by regulatory bodies who are disincentivized to evolve i.e. healthcare, education, energy

- The costs associated with industries requiring physical products or infrastructure to solve problems and meet needs i.e. climate change, construction, food and clean water access

- The intrinsic disconnect between these physical good/infrastructure businesses and the growth investment paradigm

The advent of growth capital has fundamentally changed what success looks like for founders, employees, and VC and satisfying a market is no longer a clear enough goal.

We therefore posit a new definition of product/market fit:

Product market fit means building and marketing a solution to a problem or need that a specific set of people care about solving enough to pay for it - in a market that is big enough to support your business.

.png)

Why amending the definition matters

Revising the definition of product/market fit isn’t about semantics. It is about application. If the disease is not understanding what product/market fit is and really means, the symptom of not understanding or having a methodology to assess product market fit are companies who:

1.) Don’t know what to build, for whom, and at what priority

a.) Non-existent inconsistently defined/executed or frequently changing product strategy

Unclear who sets and approves strategy, who decides what work is an isn’t on strategy, and how teams consistently collaborate on and measure success against strategy.

b.) Consensus-based roadmaps

People feel good about compromise but the product doesn’t get traction or fails to scale because it does not meet customer need in a differentiated way; often no clear decision-maker who owns product success and making/holding the line on “hard calls”

c.) Feature factory

Shipping without meaningful, measurable success metrics tied to strategy such as user engagement, revenue, or P&L improvements

2.) Don’t know how or to whom to market their product

a.) Expensive, broad brand before product

Significant capital spent on branding or superficial marketing not informed by a deeply considered product strategy

b.) Broken funnel

High top of the funnel growth numbers that show massive drop off with usage and retention rates

3.) Are unclear on what the real market opportunity is

a.) Unicorn ubiquity

The business model/market narrative is relentlessly manipulated to create even the slimmest opportunity/illusion of an opportunity that this business is poised to win a billion dollar market

Unicorn ubiquity is a result of the great growth stage capital lockdown, whereby any company willing to admit they may not be in (or want to be in) or poised to win a billion dollar market with software-business margins is not viable for traditional venture capital investment.

Sound familiar?

Most importantly product/market fit matters because

Aligning value to customers who need or want your solution enough to pay for it is the only way to build a viable, scaled business.

Read on to understand how this definition of product/market fit can be applied to enable entrepreneurs to build viable, scaled businesses.

Section 3

Erring on the side of clarity

Company context matters

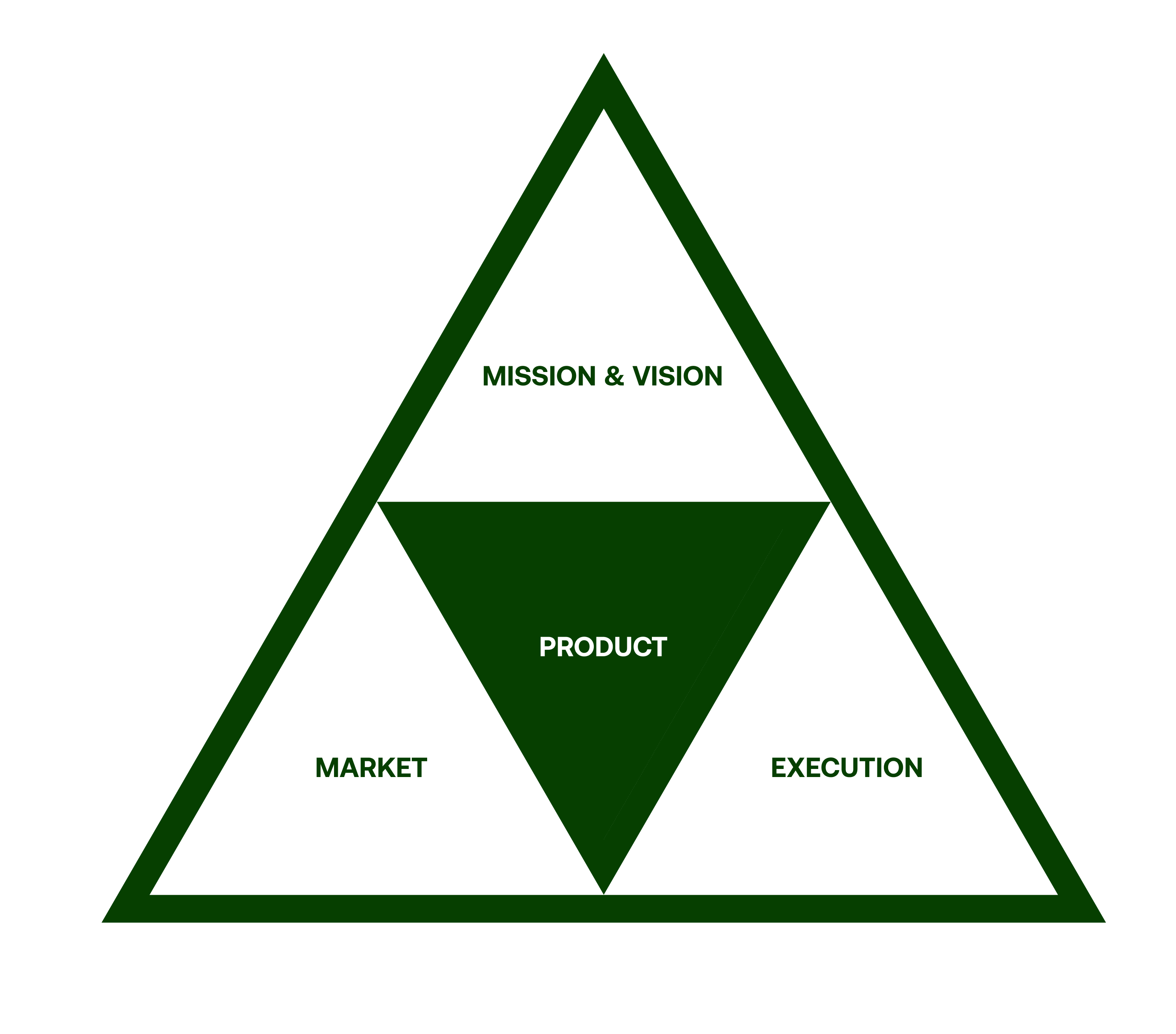

Product and market are contextualized by the mission and vision of the company at a corporate level. The key questions to answer when defining your company mission and vision are:

What’s a product?

The questions that guide company mission and vision are also useful to apply at a product level:

- What problem are you solving?

- For whom?

- Why does it matter?

A product is a solution to a problem that a specific set of people care about solving enough to pay for it.

The practical application of “pay for it” can mean a payment of money, time, or attention. Time and attention are often translated into money through digital advertising and data products. In addition to the above, the key questions to answer when defining your product are:

What’s a market?

A market is a specific set of people with a clear problem or need who are motivated to solve it with money, time, or attention.

Our definition is very similar to and partially derived from that of Geoffrey Moore who said in summary: a market is a set of customers who have a common set of needs or wants and who reference one another when making buying decisions.

The key questions to answer when defining your market are:

Avoiding hallucination

Your ideas are only as valuable as the execution muscle you are able to build to bring your product to market and realize your mission and vision. The key questions to answer when defining your execution plan are:

Section 4

1 + 1 = 5

Value exchange perspective

The magic of finding product/market fit lives at the intersection of your product’s unique value to a target market as differentiated from your competitors. At least one of the following and ideally both must be unique for you to find and sustain product/market fit:

- The definition of your target market - by value drivers (why people purchase a solution)

- Your product solution - comprised of value drivers specific to your target customers

There are two significant outputs of a thorough product/market fit exercise. The first is the value proposition of your product offering.

Your value proposition is why your solution is uniquely appealing to a specific set of people in a way that is differentiated from other solutions in the market.

A product can be differentiated across one or multiple categories including: functionality, quality, access, and price. Generally product differentiation is valued in direct relationship with the maturity of the product category.

By understanding where your product is in the product life cycle it becomes easier to prioritize focus from a development and marketing and sales (go-to-market) perspective. For example, in early stage, emerging product categories initial priority must be on creating unique value-driving functionality and solidifying the reliability and ease of use of these features.

Post establishing product/market fit and as the space matures, generally meaning expected functionality and quality standards plateau, it becomes important to focus on access and pricing as competitive differentiators.

Maintaining perspective on the value you are exchanging with your customers, including keeping a pulse on market and product category maturity, is essential to sustaining differentiation whether establishing, evolving, or defending product/market fit.

Business viability starts with market opportunity

The second significant output of the product/market fit process is a sober understanding of the market opportunity for your business.

Your business viability is first and foremost informed by your addressable or obtainable market.

Starting with a realistic market size is the most important baseline for contextualizing cost structure. Together opportunity upside and cost are the most basic drivers informing pricing and business model.

In the commonly used nomenclature of TAM (Total Available Market; demand for a solution), SAM (Serviceable Available Market; where you as a company are able to meet demand from an operational and geographic standpoint), SOM (Serviceable Obtainable Market; where you as a company a positioned to take market share), the addressable market is the same as the SOM.

Starting with and understanding your true obtainable or addressable market is something it is incumbent upon founders to deeply (and truly) understand prior to raising capital. All aspects of a company’s financial and operational plan should be informed by market and executional realities.

Not adequately understanding or intentionally obfuscating the obtainable/addressable market for the specific product solution the company is developing is the most significant reason for disconnects between investors and founders. When founders take capital on a misunderstood or misstated market opportunity, investor incentive structures are generally unable to absorb or tolerate any decrease in that valuation, whether it is executionally realistic or not.

Chasing a valuation that is out of line with the company’s core product value and true market opportunity is the main reason founders end up caught between investor objectives and the execution goals and success metrics they have set for their employees.

Fundamentally getting the value proposition or market size wrong for a particular product solution cannot be solved with creative pricing or business models. Period. On the flip side, real insight into the value exchange between a customer and a company and thoughtful market sizing creates fertile ground for exploring pricing and business model optionality.

Getting your product’s value proposition and your company’s market opportunity right are the most essential elements of entrepreneurial success.

Section 5

When to jump

Product clarity

When you have product clarity you have verified with the market:

- What your solution is and is NOT

- The value of this solution and for whom

- How users who want it can access it

- How and what customers are willing to pay for it

When you have verified these considerations you are able to make logical and transparent judgement calls to define a product strategy and owner that includes what to build as tied to clear business outcomes. This strategy includes:

- The product value drivers - informing both clear customer segmentation and the specific investment areas of the product itself

- The product offering - comprised on value drivers and versioning of features over time in a roadmap

- The access/distribution approach - informed by product lifecycle maturity and competition

- The pricing model - informed by market opportunity, maturity, and cost structure

Go-to-market clarity

When you deeply understand and have validated your product strategy with real paying customers, it is much simpler to create a prioritized approach for go-to-market. This approach means defining a clear plan for making, measuring, and refining sales and marketing investment, often through a traditional funnel.

Before this work is done, any but the lightest investments in brand are premature because brand strategy mobilizes product strategy in a way that resonates with users and fulfills the product promise.

Market opportunity clarity and so what

By doing your homework as a founder, you are able to make decisions from a place of strength about how to build a viable product and business informed by:

- A realistic market opportunity

- What is valuable in this market and if it varies by customer segment

- The other solutions at play in this market including direct competition

.png)

You are then able to scale the business by creating alignment across all aspects of a company execution plan that includes:

- Overarching business goals and success metrics

- Core/target customer segments and what they value

- Product development plan and roadmap

- Go-to-market plan across sales, marketing, and branding

- Financial and operating plan and model

- Organizational plan and structure including incentives